Gm, Marinade has identified a few issues with the current Delegation Strategy. In this thread I present another iteration of improvements that are planned to be implemented in February.

There is a playground for testing different parameters of the delegation strategy. It is a technical/work tool in alpha version, so please excuse the UI/responsivness - Marinade will further invest into development of this tool to allow easier iterations over time. https://playground.marinade.finance/

This a bit detailed draft of the Delegation Strategy (PSR not yet included in the draft): https://public.marinade.finance/Marinade_Delegation_Strategy___draft-1.pdf

The parameters, weights etc are still up for discussion but many of the things are already based on community feedback and it makes sense to make iterative improvement and later add more parameters. Perfect is the enemy of good.

Highlevel summary of the major changes follows, for details check the document linked above:

Eligibility criteria

- Eligibility criteria relied e.g. on averages of credits earned. But a lot of detail was lost when averaging.

Eligibility criteria is much stricter. Criteria for algo stake and stake directing has been unified.

Concentration score

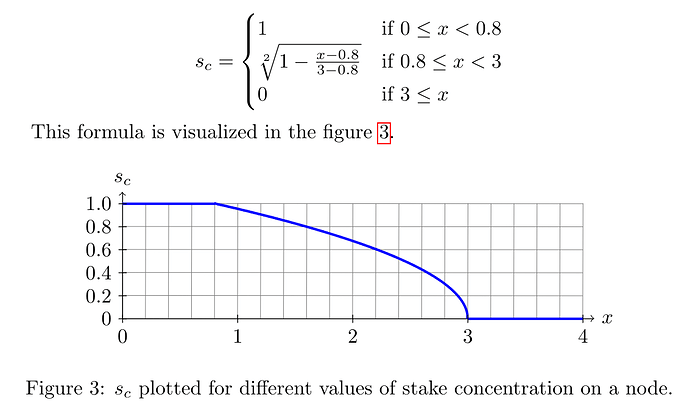

- Previously, the score was min-max normalized. The situation today is much improved and yet even not-so-concentrated data centers receive 0 score.

- Previously, the score was based on ASO only

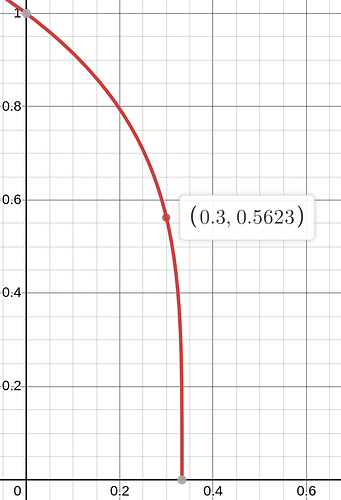

Formula used for concentration score is updated, and it consists of Country, City and ASO of the node.

Node stake

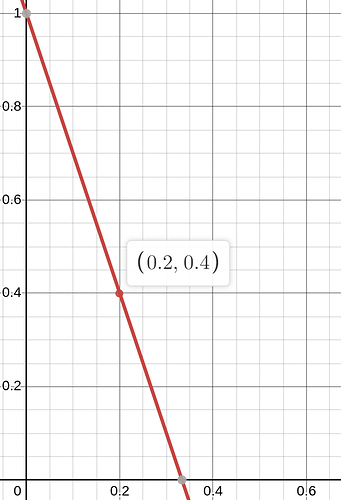

- Previously node’s stake had no effect on stake received from Marinade

The more stake the node has, the less score it will receive - up to a point where the node is no longer eligible to receive Marinade’s stake

Count of supported validators

- Algorithmic delegation supported 100 validators regardless of Marinade’s TVL.

Updated DS stakes more with more validators the more TVL there is to share

Stake directing

- Previously mSOL and MNDE controlled 20 % of directed stake each but token holders (MNDE or mSOL) had no good way of adjusting this parameter or benefit from the stake directing

This changes as MNDE/mSOL holders will be allowed to vote for algorithmic stake, effectively decreasing stake direction to specific validators. (This will be incentivized in Marinade Season #2, so holders who do not run validators can also benefit from voting)

(Please note that the directed stakes listed in the playground will change drastically, you can try modifying 0.2 mSOL/MNDE direction to 0.1 or 0.15 to better understand the impact. Also at this moment it seems that one of the large mSOL self-voters will no longer be eligible to receive Marinade stake - because of stake concentration and momentarily the votes are distributed to other voted validators)

Commission

Effect of commission on the score is now reduced

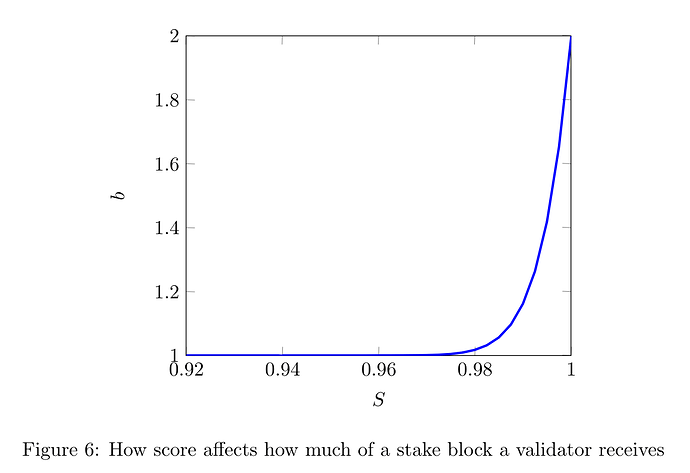

MEV

- MEV rewards - score of validators should be affected by MEV commission/rewards as well -

- MEV commission is now a new parameter of the scoring

Future ideas (not included atm)

- Tracking block quality

- Failover setup detection

- Data center seniority

- Validator client concentration (not sensible until there are at least 4)