TL;DR: We propose to allocate 25 million $MNDE tokens to deepen $mSOL liquidity in DeFi by carrying out a strategy on Solend to make looping from (collateralizing with) Meteora $mSOL/$SOL more profitable than with current $mSOL pools (like on Solend and Kamino) and other $SOL LSTs. We also propose to allocate another 25 million $MNDE tokens to incentivize existing and upcoming Solana ecosystem tokens to pair with $mSOL, thereby embedding $mSOL further into the Solana economy and also deepening its liquidity. This would be done through Kamino’s vaults and would include new and upcoming Solana ecosystem tokens as well as established protocol tokens.

The main difference between Season 3 and Seasons 1-2 is that a core focus is placed on deepening the on-chain liquidity of $mSOL, a place where Marinade is lacking relative to other $SOL LST protocols like Jito.

Hello Chefs, I am posting this after thorough discussion with some of Marinade’s advisors who have assessed the best way to handle the next phase of Marinade Earn Season 3:

As Marinade Earn — Season 2 has ended, the Marinade DAO must prepare for another season of rewards to stay competitive in the dynamic liquid staking token landscape and retain its spot as the largest DeFi protocol on Solana.

Before getting into the proposal, a quick summary of the Season 2 reward program can be made to determine its efficacy from January 1st to March 31st, 2024.

-

The DAO allocated 25 million $MNDE tokens for Season 2 to be distributed in the three months from the start of January to the end of March.

-

The base rewards for both sets of stakers ($mSOL and Native) were 1 $MNDE token per 2 $SOL staked for the full duration of the three-month program (any excess tokens, i.e., tokens unused from the 25 million $MNDE tokens allotted would be sent back to the DAO treasury).

-

In the duration of these three months, the TVL increases were as follows:

- Marinade Liquid ($mSOL) TVL grew from $718.25 million to $1.27 billion, marking around a 77% increase.

- Marinade Native TVL grew from $416.51 million to $756.54 million, marking around an 82% increase.

- Total Marinade TVL grew from around $1.135 billion to $2.027 billion, marking an overall increase in TVL of around 78.6%.

While this growth in TVL across the board cannot be solely attributed to Season 2, it goes without saying that this reward program hugely affected the protocol’s success in the last few months. Even Season 2 marked significant increases in TVL across the board for Marinade. A clear pattern can be seen here – these reward programs are efficient and help Marinade maintain its dominant position in the staking market on Solana.

Background and rationale

Recently, competition in the $SOL staking landscape has gotten more fierce. With new capital inflows into the crypto and especially the Solana ecosystem, each player in the $SOL staking landscape is doing their best to attract capital to their platform. This can be seen with the introduction of Jito’s native $JTO token, which has been used to incentivize the pairing of liquidity pools with $jitoSOL, which has proven to be effective for them. Marinade needs to keep up with this fierce competition and further solidify its place as the premier staking provider, whether Marinade Native or Liquid, on Solana.

With the newly found adoption of $jitoSOL and the proliferation of other $SOL LSTs, it is imperative that Marinade Finance, with its Liquid product, is competitive when it comes to liquidity (for $mSOL). In the liquid staking landscape on Solana, projects must compete on liquidity, as liquid staking only makes sense to the extent that composability is present and fully leveraged with deep on-chain liquidity. More specifically, the Solana network has very fast withdrawal times (ranging from a few hours to 2 days), no minimum staking requirements, and built-in delegation – so to justify going through an intermediate smart contract (using an LST like $mSOL), requires great composability, i.e., integrations with deep liquidity (e.g., to be able to trade the LST on-chain with low price impact and slippage, borrowing it on a lending market, etc.).

In this sense (more so on the on-chain liquidity front, not the integration side), Marinade is severely lacking. As it currently stands, $jitoSOL (arguably the main competitor to Marinade’s Liquid product) incurs a price impact of ~2% for a $12 million sell order. $mSOL, on the other hand, incurs a similar price impact (~2%) for a sell order of just ~$4.5 million, as quoted by Jupiter. So, despite having a higher TVL than Jito, Marinade has much lower on-chain liquidity – limiting the potential TVL of the protocol as well as meaningful utility (integrations) on the Solana network.

Recently, we have thought of a viable strategy to significantly increase the on-chain liquidity of $mSOL at low risk. We believe we incorporated it into this Season 3 reward program.

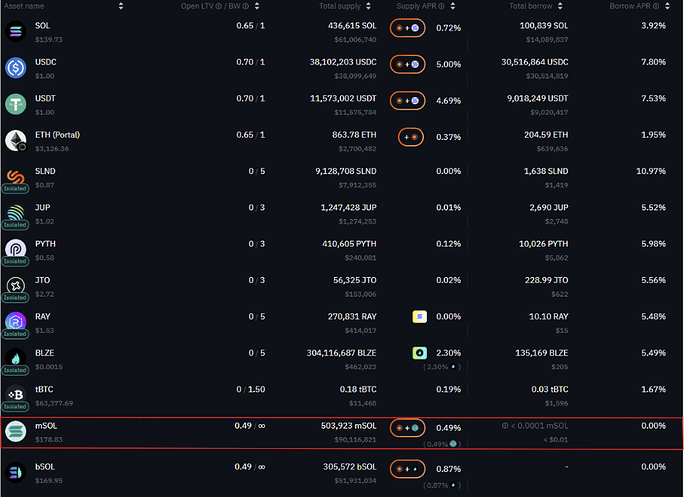

Currently, an appealing part of Marinade’s Liquid product is being able to deposit $mSOL into lending markets like Solend and Kamino and leveraging up, i.e., looping by borrowing $SOL against this $mSOL, converting it back to $mSOL and depositing it back to repeat the process. At the time of writing, around $200 million worth of $mSOL tokens are lent out (collateralized) on these lending markets, likely to pursue this leveraged (looping) strategy.

Furthermore, lending out $mSOL on Kamino/Solend and looping it currently yields significantly more than providing liquidity for the main $mSOL/$SOL pairs (e.g., on Orca) due to forgone $mSOL yield (for part of the position with exposure to vanilla $SOL) and lack of integrations for these $mSOL LP tokens (for instance, to deposit these LP tokens and leverage up, i.e., loop by borrowing $SOL against it, converting it back to said LP tokens, and repeating like it is done with $mSOL). This presents a significant opportunity cost for providing liquidity to the $mSOL/$SOL pool.

Currently, the numbers look like this:

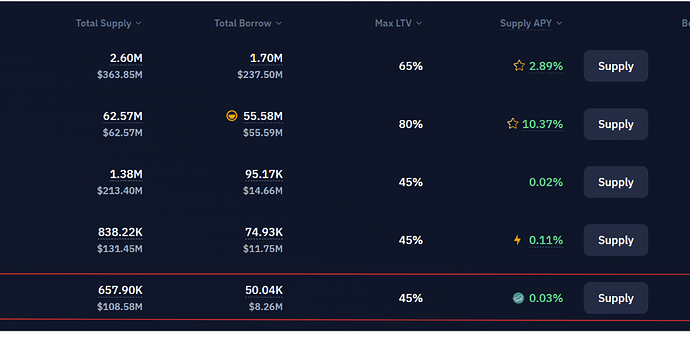

- 8.25% APY for providing liquidity for $mSOL/$SOL as seen here.

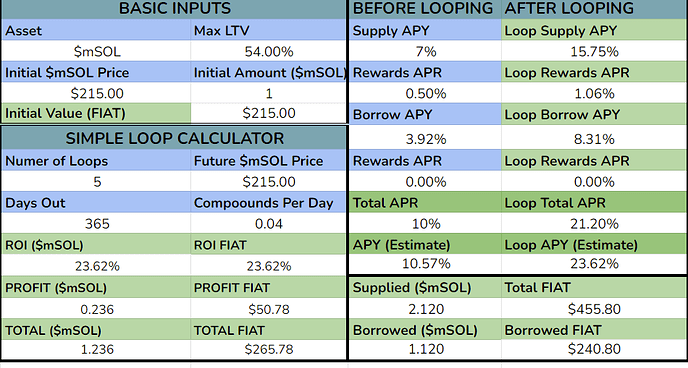

- 23.62% APY for carrying out a 5x looping strategy (the recommended) for $mSOL on Solend (a similar yield presents itself for the same on Kamino), as seen below (the parameters apply to the main $mSOL pool on Solend).

Assuming $mSOL doesn’t deviate significantly off peg relative to $SOL ($mSOL on these lending markets is hardpegged unless significant price drops relative to $SOL manifest), looping 5x is not only feasible but also relatively risk-free as long as the positive carry trade persists ($mSOL APY from lending+staking>$SOL borrowing APY), and hence, liquidations don’t take place.

This means that, for relatively low risk, $mSOL loopers can earn around 3x yield relative to liquidity provision for the $mSOL/$SOL pool. From the point of view of the protocol, every single unit of $mSOL lent out/looped on Kamino/Solend/other lending market represents an opportunity cost for potential liquidity for the $mSOL/$SOL pool. When users lend out/loop $mSOL on a lending market, they reveal their preference for exposure to $mSOL and its associated risk and trust assumptions. This means that the same user lending/looping $mSOL on a lending market would be more than fine with providing liquidity for an $mSOL/$SOL pool, as $SOL is objectively less risky than $mSOL, just as long as the yield to do so (providing liquidity for an $mSOL/$SOL pool) is higher (than lending out/looping $mSOL).

For instance, if the same carry trade as mentioned above (with any amount of leverage) is more profitable if the user lends out, i.e., uses as collateral $mSOL/$SOL LP tokens instead of $mSOL, a lot of capital will migrate (after leveraged positions are unwinded) from the existing $mSOL pools on Kamino/Solend and into the new $mSOL/$SOL pools.

To make this new $mSOL/$SOL pool more profitable relative to $mSOL one (to loop from), trading fees captured by LPs+emissions to it (in the form of $MNDE) on the lending market must be higher than the yield forgone by not having 100% exposure to yield-bearing $mSOL (as when providing liquidity, some exposure will be shifted from $mSOL to $SOL) and the impermanent loss faced by LPs, i.e., lenders/loopers.

This strategy is at the core of the Season 3 reward program.

If executed properly, a significant amount of capital can migrate from the $mSOL pools on Kamino and Solend (currently, around $200 million worth of $mSOL tokens are lent out, as seen below, and are likely used as collateral to pursue looping strategies on these lending markets) to the now main $mSOL/$SOL pool, which can then be lent out and used as collateral to loop on these lending markets. These figures also exclude other capital that is deposited into other LST protocols or $SOL-denominated pools/farms that will also likely migrate over as a result of the above (this strategy being the most profitable one if a user wants to have 100% $SOL exposure).

What do we propose?

Therefore, to induce the migration of capital from the current $mSOL pools (and other LST protocols as well as $SOL denominated pools and farms) to the new $mSOL/$SOL pools, we propose allocating 25,000,000 (25M) $MNDE tokens from the DAO treasury (which is less than 4% of $MNDE in the treasury) to the Meteora $mSOL/$SOL pool on Solend (they will be integrating this LP token into their main pool) over 5 months. Solend has around 3,000,000 (3M) $MNDE tokens leftover and in custody from previous Marinade Earn seasons that it will use to match $MNDE emissions from Season 3 to this pool.

Furthermore, to incentivize existing and upcoming Solana ecosystem tokens to pair with $mSOL, thereby embedding $mSOL further into the Solana economy and also deepening its liquidity, we propose allocating another 25,000,000 (25M) $MNDE tokens to be emitted to certain Kamino vaults paired with $mSOL that the Marinade team sees to be beneficial and have synergies with the Marinade protocol. This would include new and upcoming Solana ecosystem tokens as well as established protocol tokens.

It is also worth noting that Kamino has around 1,000,000 (1M) $MNDE tokens leftover and in custody from previous Marinade Earn seasons that it will use to match $MNDE emissions from Season 3 to its vaults.

Any other considerations?

-

Meteora will likely match, to some extent, $MNDE emissions to the $mSOL/$SOL pool on Solend with their $MET token.

-

Projects that had their token paired with $mSOL on a Kamino vault will also likely contribute more of their native token to match, to some extent, $MNDE emissions to it.

-

For the part of this Season 3 program that aims to deepen liquidity through the lending market strategy on Solend, it is prudent to consider the fact that liquidity will not only migrate to the $mSOL/$SOL pool from the current $mSOL pool but also from all around the Solana ecosystem as this venue will likely be the highest yielding one for 100% $SOL exposure. This is important to consider in light of the fact that current $mSOL looped positions will likely be hard to unwind as flash loans cannot be utilized because $mSOL liquidity relative to the current $mSOL pool size is low, and users will likely have to go through a redemption process. This will mean that it will take time for users, mostly those with larger positions, to unwind their current positions and migrate to the higher earning $mSOL/$SOL pool and carry out the leveraged carry trade (looped position) there. Moreover, a lot of $mSOL currently lent out, i.e., collateralized, is not used to borrow any $SOL and establish a looped position, so this $mSOL can also easily migrate to the new pool alongside other liquidity from the Solana ecosystem.

Considering protected staking rewards (PSR) are launching soon, along with other massive upgrades to the Marinade protocol that will be announced shortly, we think Season 3 is the best way to complement these upgrades and significantly deepening on-chain liquidity for $mSOL, which was not a core focus of previous seasons. In retrospect, not having a core focus on deepening $mSOL liquidity through previous Marinade Earn programs was a mistake – one we hope to rectify with this Season 3 program.

We’re keen to hear your valuable thoughts, Chefs.