Hello Chefs!

I would like to propose adding a liquidity gauge for the mSOL/USH pair on Orca Whirlpools. USH is a decentralized, overcollateralized stablecoin minted against various crypto assets such as SOL, mSOL, and Solend’s cTokens, created by Hedge (hedge.so).

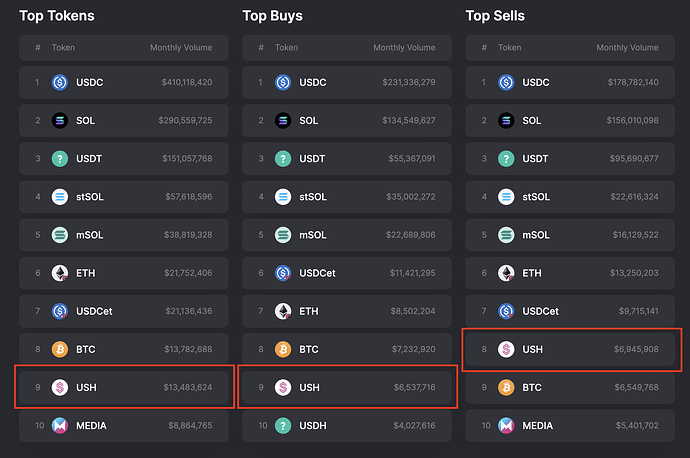

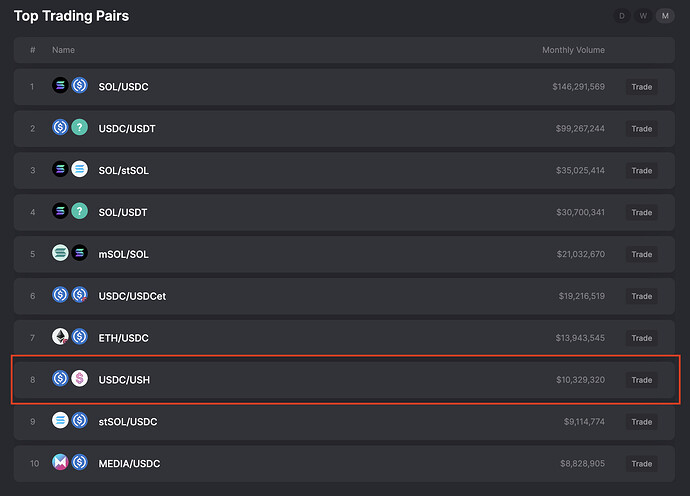

Currently there is over 9M USH in circulation and USH is consistently one of the top traded tokens on Jupiter, currently it is the most traded decentralized stablecoin per month (screenshots taken from jup.ag/stats on Oct 28th).

USH can be minted against mSOL on Hedge, and with the auto-leverage feature users can leverage up their mSOL exposure by minting USH, swapping for mSOL and redepositing it into their mSOL vault one click. Deeper liquidity on mSOL/USH will reduce slippage on this loop and make this strategy more attractive.

To kickstart the Whirlpool, it will also be incentivized with ORCA and HDG (Hedge’s protocol token) in addition to MNDE rewards from the liquidity gauge.

Please let me know if you have any questions or concerns with this proposed liquidity gauge!

Thanks,

Hao (Core contribute at Hedge)