What do you propose?

I propose the following:

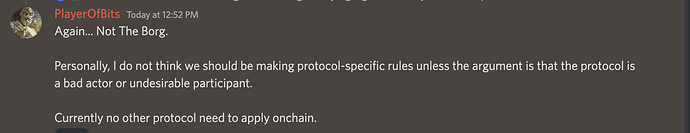

- The prevention of the creation of “permissioned or fully closed pools” liquidity gauges.

- Permissioned - being that having a list of addresses, which are controlled by another entity

- Fully closed - pools that do not accept liquidity or capital from other people

This includes the removal the current Lifinity liquidity gauge where deposits are limited to only Lifinityan d prevent the creation of future closed off or permissioned liquidity gauges.

This proposal would include the removal of Lifinity’s gauge, regardless of whether they choose to open the pools. They are welcome to re-apply for a gauge after this proposal has passed, subject to the Chef’s screening process from start to end.

What is the rationale behind the proposal?

“One of Marinade core value is decentralization, including the spreading of MNDE ownership around the ecosystem, so we should not allow Liquidy Mining Gauges for large pools that are private by design of by lack of community participation, because that leads to a feedback loop of MNDE concentration rather than decentralization”

This was eloquently put by Lucio, and I think serves as a good summary of the “why” of this proposal.

This proposal’s goal is to restore liquidity gauges to it’s original purpose:

“MNDE Liquidity mining serves 2 functions in Marinade:

- it incentivizes staking SOL and using it in DeFi integrations, being a means of acquisition and retention

- it spreads the ownership of MNDE around in the ecosystem to its users, decentralizing Marinade”

This was demostrated by Lifinity. (Lifinity constantly receiving MNDE and relocking it for more MNDE rewards, leading to exponential growth). This proposal aims to solve the root issue (liquidity gauges), and open the door for Lifinity to change their current model (opening the gauges as Durden suggested?) before re-applying for a gauge uner the new model. While many wont believe that this is a pitchfork session on Lifinity, it is really trying to just solve the root problem.

What is the expected positive impact of this change?

The removal of the Lifinity gauge should see more incentives driven towards other AMMs (Orca and Raydium) and other DeFi platforms. While also keeping (hopefully) the liquidity/value add that Lifinity provides. (Once again, I highly suggest a pivot to volume goals instead of shutting the pool and dumping MNDE).

Under a more aligned model, mDAO benefits from Lifinity in a measurable manner, while also encouraging other DeFi protocols to participate. This should see more mSOL TVL growth and mDAO participation from other DeFi protocols.

More MNDE has to come from somewhere else to reward Lifinity, but mDAO won’t be overpaying for Lifinity’s liquidity as much as they are now and discouraging more protocols from acquiring MNDE.

Any other considerations?

There are a few potential risks with the proposal:

- Will Lifinity stop participation in mDAO, due to the perceived violation of their grant terms?

- How hard is it to monitor different liquidity gauges that they are playing by the rules (set out here.)

- How will other DeFi protocols react to this change? Maintaining these relationships between various DeFi protocols and mDAO is important.

Under the proposal, we have Hao from Hedge/Nazare, and Rooter/Nope from the Solend team commenting. It would be ideal to see more DeFi protocols commenting here to ensure that the change is seen favorably. Lifinity has been an active participant in mDAO and would benefit from a pivot in reward mechanism. For the sake of keeping this proposal focused, I suggest we bring up the Lifinity’s volume goals in a separate proposal.

While I feel that a volume based model will aligns mDAO and Lifinity’s interests better than the current model. I note that this was what Lifinity initially proposed, and views upon it negatively… However the current model, Lifinity’s gauge receives 10% of MNDE incentives, regardless of any volume or results achieved, which is less than ideal for mDAO.

I am not arguing that Lifinity is -ev for MarinadeDAO. I am for volume based goals, and a way of quantifiable goals (volume, spread, execution) to be presented and assessed, instead of Lifinity utilizing its MNDE (that it got as a grant) to drive more MNDE to themselves.

This model discourages other DeFi protocols from accumulating MNDE as Lifinity got a headstart for free. (As mentioned by mst from Tulip)